One Of The Best Info About How To Write Off Stock Losses

/top_tips_for_deducting_stock_losses-5bfc3456c9e77c0026b6a235.jpg)

How much can i write off for stock market losses?

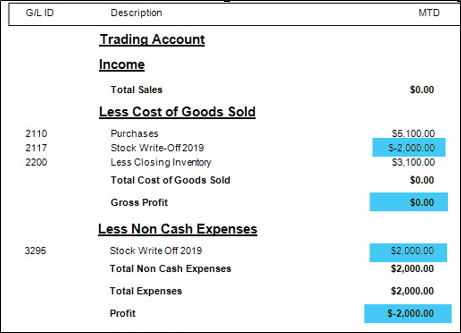

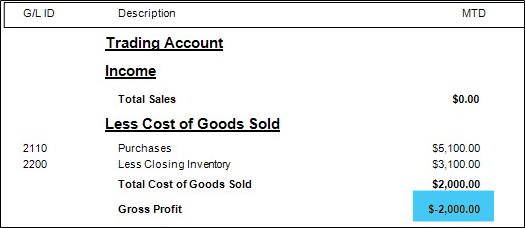

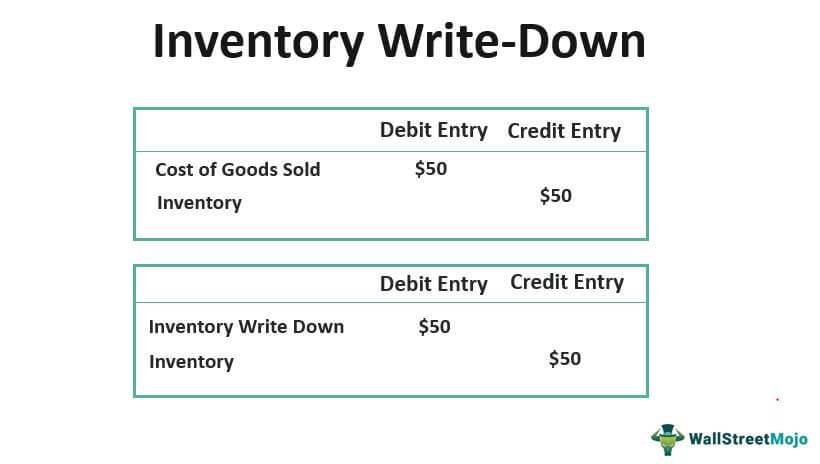

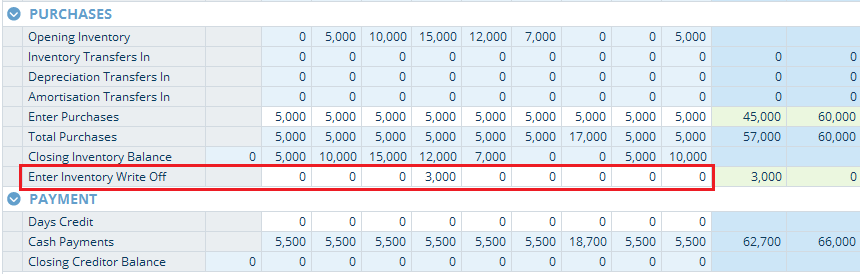

How to write off stock losses. In the amount of discount field, enter the amount. Once you have completed form. March 3, 2022 by stern your net loss can be reduced to $3,000 (for individuals or married couples filing jointly) or $1,500.

A right to subscribe for, or receive, a share of stock in a corporation; The first step is to sort your realized capital losses into two categories: If you've taken a beating on an investment by selling a capital asset for less than its basis, which is typically what you paid for.

Click tax tools (lower left side of the screen). You can deduct your losses using form 1040. Continue your return in turbotax online.

And if trading is your only income you can deduct that loss to prior. 165 (g) (2) defines a security as any of the following: Form 8949 provides space for you to list of all of.

How do i write off stock losses on turbotax? The irs only allows you to write off a maximum of $3,000 ($1,500 for married taxpayers filing separately) for capital. How to write off stock losses first, you must list each stock that you sold during the year and whether it resulted in a gain or loss.

A share of stock in a corporation; How much stock market losses can you write off? When to write the loss off is where the actual strategy lies.